What is a bank account?

A bank account is a financial account that allows you to store and access your funds. There are two main types of bank accounts: chequing accounts, used for daily transactions, and savings accounts, used to set aside money you don’t plan on using every day.

Banking that's made for you

Unlimited no fee self-serve transfers to your other BMO accounts*99 including mobile and online transfers, and ATM

No monthly fee or minimum balance

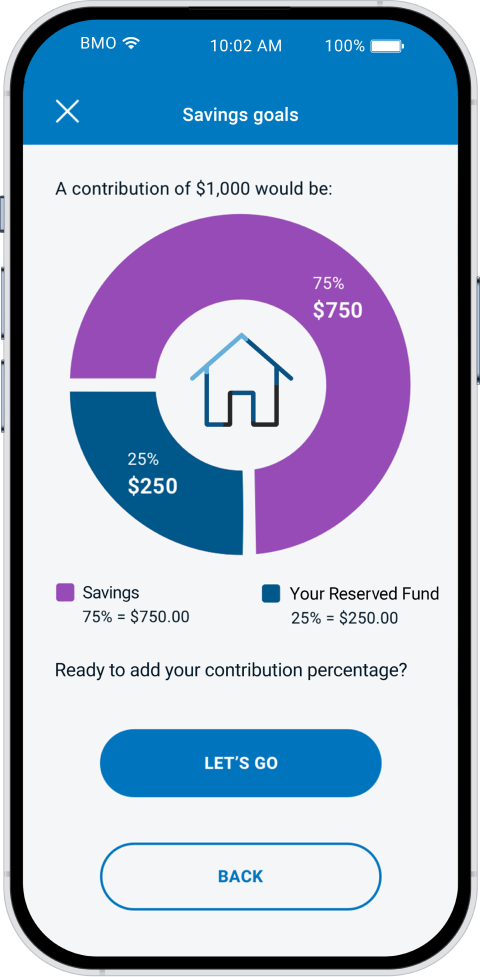

Benefit from a competitive interest rate and earn money back when you save

Start using the BMO Savings Goals Feature

Mobile

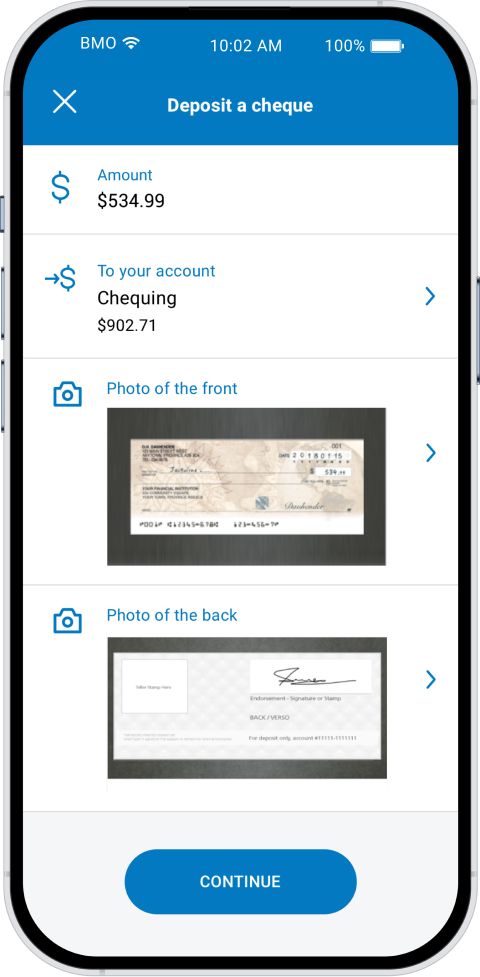

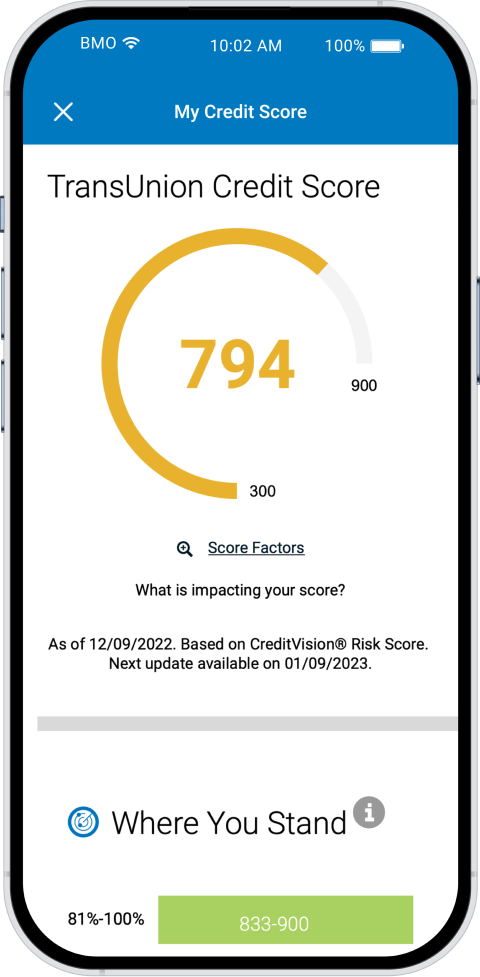

Easy, secure digital banking

One household, one monthly fee

Open a qualifying chequing account and save on fees for family members with the BMO Family Bundle.*86

Bank Accounts FAQs

BMO offers several chequing accounts, including:

- Performance: Get an opening bonus as well as unlimited transactions, and no monthly plan fee when you maintain a $4,000 balance. You can also get up to $40 in rebates on the annual fee for eligible BMO credit cards, OnGuard Identity Theft Protection, and other benefits.

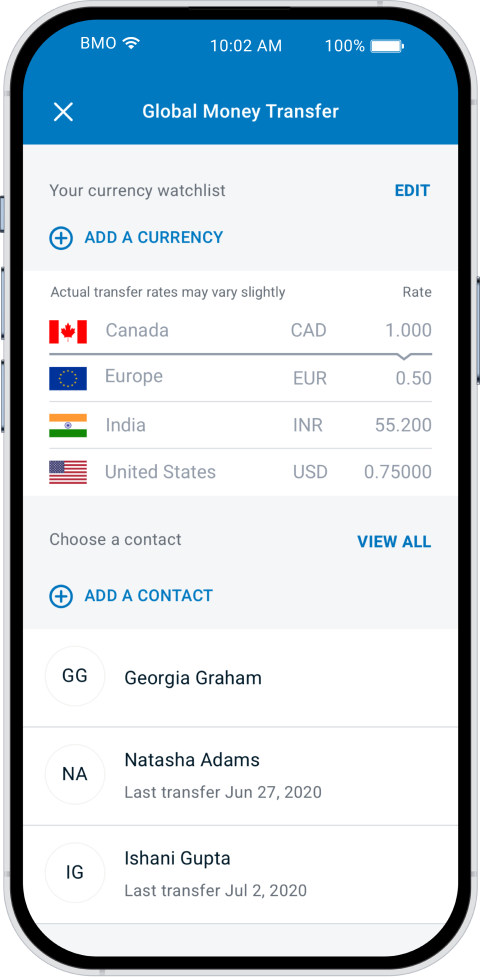

- Premium: Get an opening cash bonus as well as unlimited transactions, and no monthly plan fee when you maintain a $6,000 balance. You can also get no fee Global Money Transfers, up to $150 in rebates on the annual fee for eligible BMO credit cards, OnGuard Identity Theft Protection, and other benefits.

- Plus: Get an opening cash bonus as well as 25 transactions per month, and no monthly plan fee when you maintain a $3,000 balance.

- Practical: Get a low monthly plan fee of $4.00, 12 transactions per month, and unlimited INTERAC e-Transfers®section

- AIR MILES: Earn 1 AIR MILES Reward Mile for every $30 spent using your BMO Debit Card, and 25 Bonus Miles each month with a BMO AIR MILES World Mastercard®* or BMO AIR MILES World Elite®* Mastercard.

Manage your pre-authorized payments with BMO Powerswitch

With BMO Powerswitch, we make switching to BMO easy. Simply transfer your pre-authorized payments from another financial institution to your new BMO bank account online in minutes. Current BMO customer can also use BMO Powerswitch to manage pre-authorized payments.

Resources

Understanding Chequing Accounts in 2025

We examine the ubiquitous chequing account – its versatility, benefits, types and more – and why it’s so popular.

How to find the best chequing account for your lifestyle

Why settle for a generic chequing account when you can find one that fits your lifestyle?

What’s the difference between a chequing and savings account?

Compare chequing vs. savings accounts and learn how you can use them both to your advantage.